Chris is an award-winning former journalist with 15 years of experience in the mortgage industry. A national expert in VA lending and author of “The Book on VA Loans,” Chris has been featured in The New York Times, the Wall Street Journal and more.

Updated on April 11, 2024 Veterans: Check your $0 down eligibility today! Expert Reviewed At a GlanceVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them.

Within this ArticleVA renovation loans, often referred to as VA rehab loans, VA reno loans, VA supplemental loans or VA home improvement loans, offer Veterans and service members a low-cost, no-down-payment way to purchase fixer-uppers or homes in need of some extra TLC.

Through VA renovation loans, borrowers can finance both the purchase of a home and the completion of any necessary repairs or renovations. But it’s important to understand the limitations of this special loan option, including that it can be difficult to find lenders that make them.

The renovation loan is basically the VA's answer to the FHA 203(k) loan. It allows eligible Veterans to purchase and repair a property using a single VA loan. Like traditional VA loans, these mortgages require no down payment and no mortgage insurance. However, borrowers will have a challenging time finding a lender, as few actually offer VA rehab loans. Like most VA lenders, Veterans United does not provide this type of financing.

VA renovation loans essentially roll the purchase price of the home and the costs of any expected repairs or improvements into one single loan (and, therefore one single payment).

The total amount you can finance depends on the estimated "as-completed" value of the home -- meaning the projected market value of the property once all repairs are finished.

To find out a property's as-completed value, you'll need to get itemized quotes from a contractor on any repairs or improvements you plan to make. Then, a VA appraiser will review this and determine the home's future value.

With a VA renovation loan, the as-completed value must always be the lesser of the total acquisition cost or the as-completed value determined by the VA appraiser.

For example, if the sale price of the home, including closing costs, is $155,000, and renovations are $50,000, the total acquisition cost is $205,000. If the VA appraiser gave a Notice of Value (NOV) of $210,000, the lesser amount of $205,000 is used for the as-completed value.

VA loans and VA rehab or renovation loans are essentially the same product. The only real difference is that the VA rehab loan is designated "for alteration and repair" of a home. In contrast, traditional VA loans are simply a home purchase or refinance product.

With a refinance, VA renovation loans are technically supplemental loans. If a property and borrower are approved for a VA loan, they may also be able to get a supplemental loan for repairing the property on top of that.

Borrowers using a VA renovation loan must meet the basic VA loan service requirements and have a valid Certificate of Eligibility. Credit scores vary by lender, but you'll often need at least a 620 mortgage credit score.

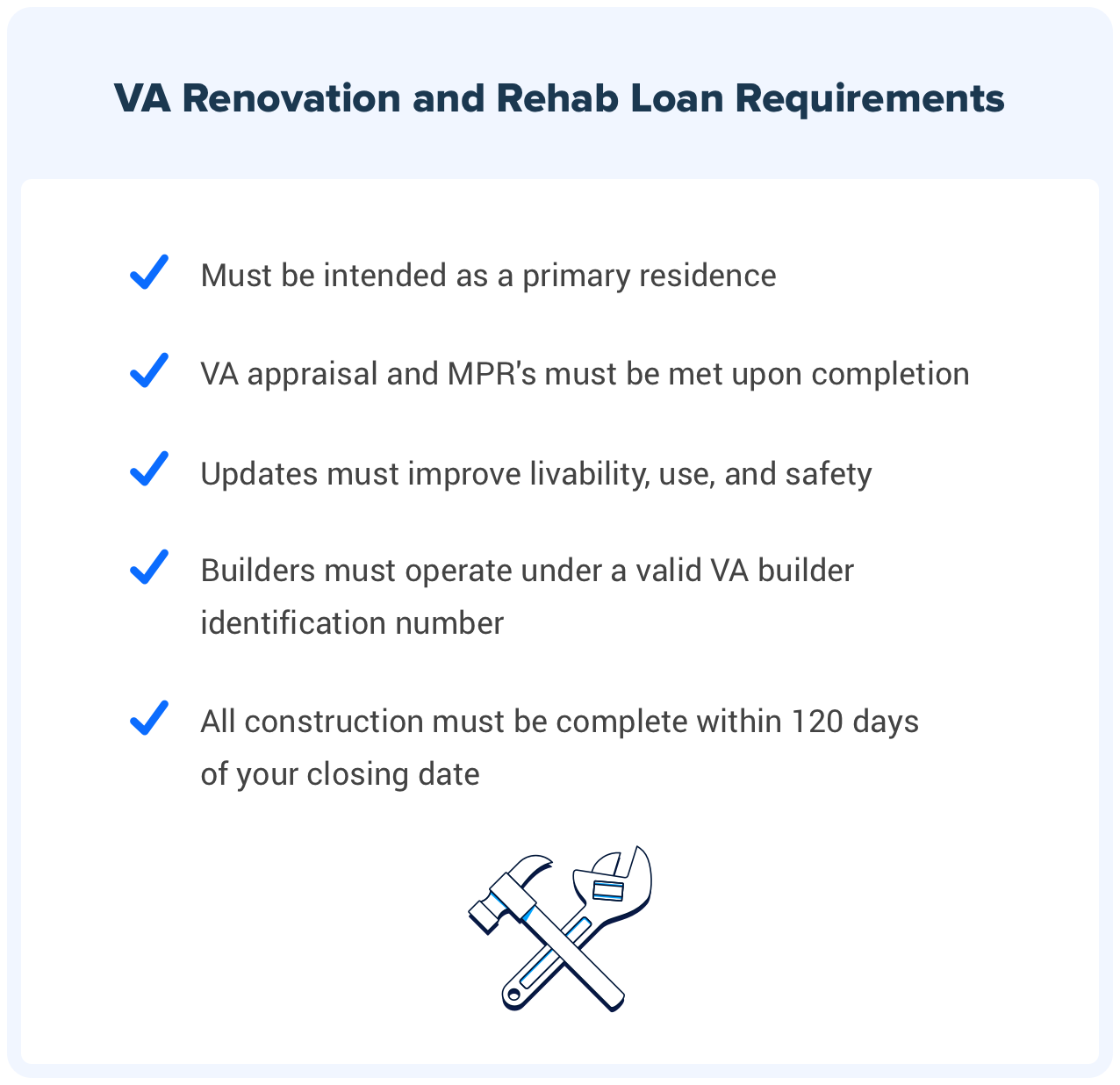

In addition to the basic VA loan requirements, a renovation loan will also require that:

If you're refinancing, your loan-to-value ratio must be 90% or less. You also must have been in the home for at least 12 months.

There are some limits to what you can repair and improve using a VA renovation loan.

You can't do major structural work, add a new floor or room, install a swimming pool or make landscaping improvements. You also can't put up a detached garage. Anything that requires a structural engineering report is off-limits.

Here's what you can do:

In general, the project has to improve the property's livability and value and must become a permanent part of the home.

» CALCULATE: Calculate your VA Loan savings

| Pros | Cons |

| One loan for purchase and improvement | Limited uses |

| No down payment required | Not many lenders offer it |

| Ideal for competitive housing markets | Builders must be VA-approved |

| Lower interest rates than other home improvement options | Work must be completed within 120 days |

Since VA rehab/renovation loans come with all the perks of traditional VA loans (low rates, no down payment, etc.), there aren't many downsides. The biggest disadvantage is that these loans can't cover major structural repairs or, on the flip side, more luxurious updates (like adding a pool or fire pit, for example).

VA renovation loans are also limited in what properties they can be used on. Like traditional VA loans, they can't be used on rental properties or properties you intend to fix-and-flip. For these projects, a HomeStyle loan may be a better option.

If a VA rehab loan isn't the right fit for what you have in mind, there are other ways to finance the purchase of a fixer-upper or refinance and repair a home you already own:

VA Energy Efficient Mortgage: If you want to make specific green updates to your property, an EEM loan may be a better fit. These mortgages can help you finance solar water heaters, weatherize the home, install programmable thermostats, add storm windows and other qualified improvements.

VA Cash-Out Refinance: A cash-out refinance can allow you to tap your home equity and use that extra cash toward home improvements and repairs. The VA offers cash-out refinances for qualified homeowners.

Specially Adapted Housing grants: If you need to make home improvements to accommodate a disability, then the VA's Specially Adapted Housing Grant can help. These loans can also be used to improve a caretaker's home if necessary.

If you're willing to venture outside the VA, you can use a home equity loan, home equity line of credit (HELOC) or FHA 203(k) loan. These can all either free up cash or help you directly finance your home repairs and improvements.

See What You Qualify ForAnswer a few questions below to speak with a specialist about what your military service has earned you.

Chris Birk is the author of “The Book on VA Loans: An Essential Guide to Maximizing Your Home Loan Benefits.” An award-winning former journalist, Chris writes about mortgages and homebuying for a host of sites and publications. His analysis and articles have appeared at The New York Times, the Wall Street Journal, USA Today, ABC News, CBS News, Military.com and more. More than 300,000 people follow VA Loans Insider, his interactive VA loan community on Facebook.

About Our Editorial Process

Veterans United is recognized as the leading VA lender in the nation, unmatched in our specialization and expertise in VA loans. Our strict adherence to accuracy and the highest editorial standards guarantees our information is based on thoroughly vetted, unbiased research. Committed to excellence, we offer guidance to our nation's Veterans, ensuring their homebuying experience is informed, seamless and secured with integrity.

The VA funding fee is a governmental fee required for many VA borrowers. However, some Veterans are exempt, and the fee varies by VA loan usage and other factors. Here we explore the ins and outs of the VA funding fee, current charts, who's exempt and a handful of unique scenarios.

Can Your Mortgage Be Denied After Preapproval? Updated on April 15, 2024It is possible for you to get denied for a home loan after being preapproved. Find out why this may happen and what you can do to prevent it.